content of level

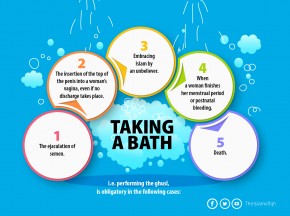

Taking a bath (Ghusl)

1-The ejaculation of semen.2- The insertion of the top of the penis into a woman’s vagina, even if no discharge takes place.3- Embracing Islam by an unbeliever.4- When a woman finishes her menstrual period or postnatal bleeding.5- Death.

Requirements of Ablution

1.Belief in Islam, sanity and sense of discrimination. 2.Intention. 3. clean water. 4 .Removal of anything that prevents skin contact with water (wax or dough on some spots, or nail varnish) 5.Immediate progress from one action to the next. 6.Following the proper order. 7.Washing all the organs that are required to be washed.

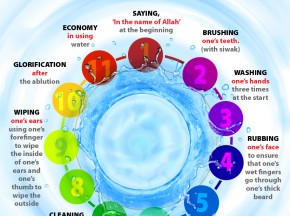

Recommended- Sunnah acts of Ablution

1.Saying, ‘In the name of Allah’ at the beginning2.Brushing one’s teeth. (with siwak)3.Washing one’s hands three times at the start,4.Rubbing one’s face to ensure that one’s wet fingers go through one’s thick beard.5.Starting with the right hand or foot, as the Prophet did6.Washing one’s face, hands and feet three times.7.Rinsing one’s mouth.8.Cleaning one’s nose.9.Wiping one’s ears using one’s forefinger to wipe the inside of one’s ears and one’s thumb to wipe the outside.10.Glorification after the ablution11.Economy in using water.

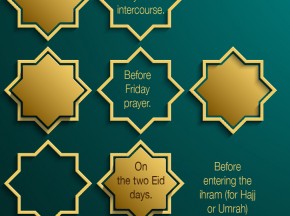

Recommended ghusl

1-After every sexual intercourse. 2-Before Friday prayer. 3-On the two Eid days. 4-Before entering the ihram (for Hajj or Umrah). 5-After washing the dead person.

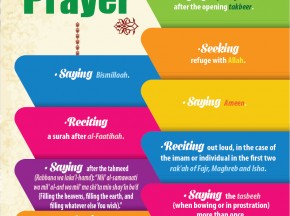

What is recommended in prayer

· Saying (opening du’aa’) after the opening takbeer. · Seeking refuge with Allah. · Saying Bismillaah. · Saying Ameen. · Reciting a surah after al-Faatihah. · Reciting out loud, in the case of the imam or individual in the first two rak'ah of Fajr, Maghreb and Isha. ·Saying after the tahmeed (Rabbana wa laka’l-hamd): “Mil’ al-samawaati wa mil’ al-ard wa mil’ ma shi’ta min shay’in ba’d (Filling the heavens, filling the earth, and filling whatever else You wish).” ·Saying the tasbeeh (when bowing or in prostration) more than once, such as a second or third time or more. · Saying “Rabb ighfir li (Lord forgive me)” more than once between the two prostrations. ·Saying the recommended du’aa’ after offering the salutation upon the Prophet (peace be upon him) and his family known as Assalatul Ibrahimiyah.

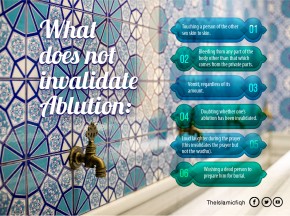

What does not invalidate Ablution

1. Touching a person of the other sex skin to skin. 2. Bleeding from any part of the body other than that which comes from the private parts. 3. Vomit, regardless of its amount. 4. Doubting whether one’s ablution has been invalidated. 5. Loud laughter during the prayer (this invalidates the prayer but not the wudhu). 6. Washing a dead person to prepare him for burial.

Duties in prayer

1-Saying Allahu Akbar in every movement. 2-The imam leading the prayer and a person praying alone says: sami a Allah liman hamidah (‘may Allah answer the prayer of the one who praises Him’) when standing up after bowing 3-Then when he was in the upright position he said: Rabbana wa lak alh md i.e. “You are our Lord and all praise is due to You”’. 4-Every worshipper in the congregation says only Rabbana wa lak alhamd, while al imam says it immediately after sami Allah liman hamidah. 5-Saying Subhana Rabbi al 'Azeem when bowing, which means: Limitless is Allah in His Glory 6-Saying Subhana Rabbi al 'Aala when prostrating, which means: Glorified be My Lord, the Most High. 7-Saying: Rabbi-gh-firli when sitting between the 2 prostrations, which means: forgive me, my Lord. 8-The first tashahhud, except for people in the congregation when the imam forgets this tashahhud and rises for the next rakah. Those in the congregation are exempt from it because they have an overriding obligation to follow the imam.

Conditions allowing dry ablution

1-Intention to uplift minor or major impurity. 2-Possession of mental faculties. 3-Awareness. 4-Inability to use water for ablution. 5-Dry ablution must be with pure dust.

Conditions for wiping over the khuffs

•a valid ablution at the time when one wears the khuffs , or socks. •Covering all the feet up to the ankle. •They must be permissible to wear (i.e.: not being stolen, made from silk, etc). •They should be made of pure material. •Do not exceed the time of concession. Khuff is valid for one day and night for one who is in his home town, and for three days and nights for for one on travel.

Conditions for the validity of prayer

1-Islam: Prayer is not valid if performed by an unbeliever. 2-Sanity: Prayer is not valid if performed by an insane person. 3-Puberty: It is not required of a child until he or she attains puberty. 4-Purification: From any discharge that invalidates ablution. 5-Appropriate time: Each prayer has its appointed time range and for a prayer to be valid. 6-Covering the awrah, which is the private parts and the area around them. 7-Avoiding all impurity on one’s body, clothes and the place where one is praying. 8-Facing the qiblah (i.e. the direction towards the Ka bah) when one is able to do so. 9-Intention: The intention is a mental process and need not be vocalized.

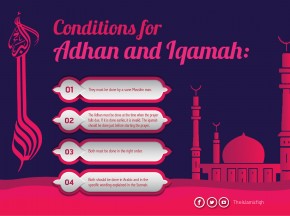

Conditions for Adhan and Iqamah

1- They must be done by a sane Muslim man. 2- The Adhan must be done at the time when the prayer falls due. If it is done earlier, it is invalid. The iqamah should be done just before starting the prayer, 3- Both must be done in the right order. 4- Both should be done in Arabic and in the specific wording explained in the Sunnah.

Missing previous Ramadans

Missing previous Ramadans.

Postponing the zakat for Ramadan

Postponing the zakat for Ramadan.

Is sleeping a form of worship during Ramadan

Is sleeping a form of worship during ramadhan?

What I need to do if I missed my fasting during Ramadan due to pregnancy.

What I need to do if I missed my fasting during Ramadan due to pregnancy.

Can a woman staying in Saudi do umrah without her mahram

Can a woman staying in Saudi do umrah without her mahram.

What would a woman do in last 10 days of ramadhan

What would a woman do in last 10 days of ramadhan.

Ruling on breastfeeding woman during ramadhan

Ruling on breastfeeding woman during ramadhan.

Ruling on taking medicines to delay menses during ramadhan

Ruling on taking medicines to delay menses during ramadhan.

Can a woman with menses eat during ramadhan

Can a woman with menses eat during ramadhan.